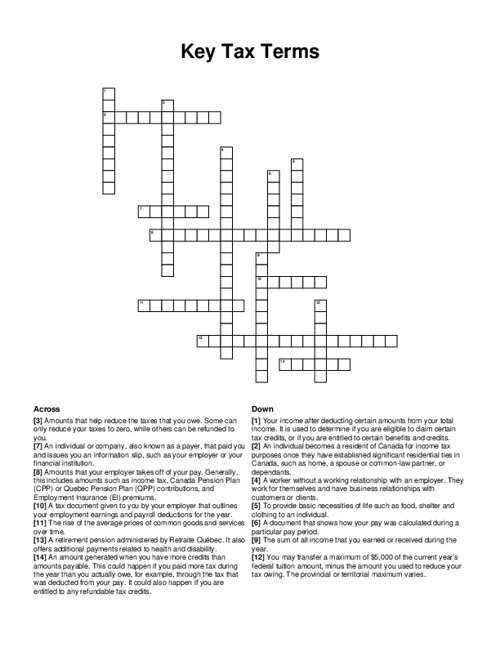

Key Tax Terms Crossword Puzzle

Download and print this Key Tax Terms crossword puzzle.

Related puzzles:

Browse all Business / Finance Puzzles

QUESTIONS LIST:

- maximum : you may transfer a maximum of $5,000 of the current year’s federal tuition amount, minus the amount you used to reduce your tax owing. the provincial or territorial maximum varies.

- net income : your income after deducting certain amounts from your total income. it is used to determine if you are eligible to claim certain tax credits, or if you are entitled to certain benefits and credits.

- pay stub : a document that shows how your pay was calculated during a particular pay period.

- refund : an amount generated when you have more credits than amounts payable. this could happen if you paid more tax during the year than you actually owe, for example, through the tax that was deducted from your pay. it could also happen if you are entitled to any refundable tax credits.

- support : to provide basic necessities of life such as food, shelter and clothing to an individual.

- t4 slip : a tax document given to you by your employer that outlines your employment earnings and payroll deductions for the year.

- tax credits : amounts that help reduce the taxes that you owe. some can only reduce your taxes to zero, while others can be refunded to you.

- total income : the sum of all income that you earned or received during the year.

- self employed worker : a worker without a working relationship with an employer. they work for themselves and have business relationships with customers or clients.

- residency status : an individual becomes a resident of canada for income tax purposes once they have established significant residential ties in canada, such as home, a spouse or common-law partner, or dependants.

- quebec pension plan : a retirement pension administered by retraite québec. it also offers additional payments related to health and disability.

- payroll deductions : amounts that your employer takes off of your pay. generally, this includes amounts such as income tax, canada pension plan (cpp) or quebec pension plan (qpp) contributions, and employment insurance (ei) premiums.

- issuer : an individual or company, also known as a payer, that paid you and issues you an information slip, such as your employer or your financial institution.

- inflation : the rise of the average prices of common goods and services over time.