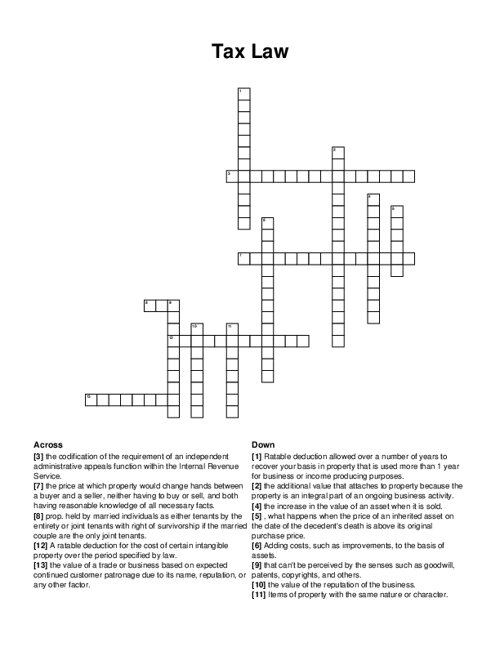

Tax Law Crossword Puzzle

Download and print this Tax Law crossword puzzle.

Related puzzles:

Browse all Business / Finance Puzzles

QUESTIONS LIST:

- capital gain: the increase in the value of an asset when it is sold.

- goodwill: the value of the reputation of the business.

- taxpayer first act: the codification of the requirement of an independent administrative appeals function within the internal revenue service.

- step up:, what happens when the price of an inherited asset on the date of the decedent's death is above its original purchase price.

- qji: prop. held by married individuals as either tenants by the entirety or joint tenants with right of survivorship if the married couple are the only joint tenants.

- amortization: a ratable deduction for the cost of certain intangible property over the period specified by law.

- capitalization: adding costs, such as improvements, to the basis of assets.

- depreciation: ratable deduction allowed over a number of years to recover your basis in property that is used more than 1 year for business or income producing purposes.

- fair market value: the price at which property would change hands between a buyer and a seller, neither having to buy or sell, and both having reasonable knowledge of all necessary facts.

- going concern value: the additional value that attaches to property because the property is an integral part of an ongoing business activity.

- goodwill: the value of a trade or business based on expected continued customer patronage due to its name, reputation, or any other factor.

- intangible: that can't be perceived by the senses such as goodwill, patents, copyrights, and others.

- like kind: items of property with the same nature or character.