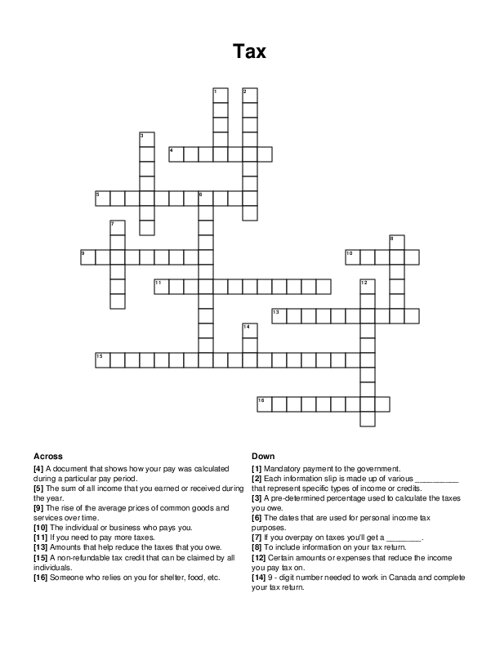

Tax Crossword Puzzle

Download and print this Tax crossword puzzle.

Related puzzles:

Browse all Business / Finance Puzzles

QUESTIONS LIST:

- box number : each information slip is made up of various _ that represent specific types of income or credits.

- basic personal amount : a non-refundable tax credit that can be claimed by all individuals.

- calendar year : the dates that are used for personal income tax purposes.

- deductions : certain amounts or expenses that reduce the income you pay tax on.

- inflation : the rise of the average prices of common goods and services over time.

- pay stub : a document that shows how your pay was calculated during a particular pay period.

- report : to include information on your tax return.

- sin : 9 - digit number needed to work in canada and complete your tax return.

- tax rate : a pre-determined percentage used to calculate the taxes you owe.

- total income : the sum of all income that you earned or received during the year.

- taxes : mandatory payment to the government.

- refund : if you overpay on taxes you'll get a _ .

- balance owing : if you need to pay more taxes.

- dependent : someone who relies on you for shelter, food, etc.

- payer : the individual or business who pays you.

- tax credits : amounts that help reduce the taxes that you owe.