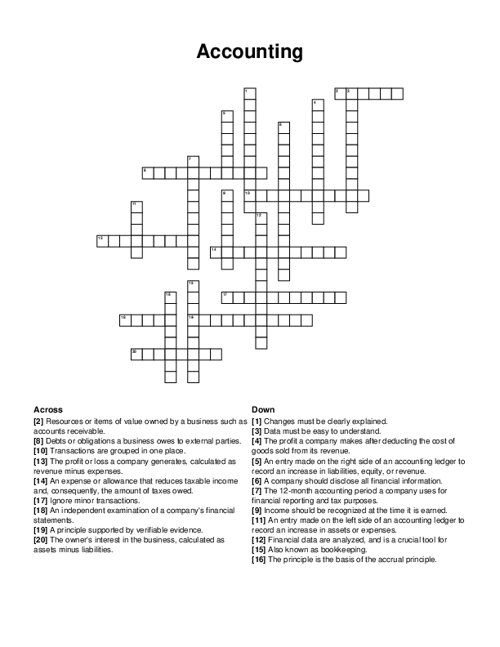

Accounting Crossword Puzzle

Download and print this Accounting crossword puzzle.

Related puzzles:

Browse all Business / Finance Puzzles

QUESTIONS LIST:

- recording : also known as bookkeeping.

- classifying : transactions are grouped in one place.

- fiscal year : the 12-month accounting period a company uses for financial reporting and tax purposes.

- objectivity : a principle supported by verifiable evidence.

- equility : the owner's interest in the business, calculated as assets minus liabilities.

- consistency : changes must be clearly explained.

- summarizing : data must be easy to understand.

- net income : the profit or loss a company generates, calculated as revenue minus expenses.

- liabilities: debts or obligations a business owes to external parties.

- materiality : ignore minor transactions.

- decision making.

- credit : an entry made on the right side of an accounting ledger to record an increase in liabilities, equity, or revenue.

- audit : an independent examination of a company's financial statements.

- full disclosure : a company should disclose all financial information.

- debit : an entry made on the left side of an accounting ledger to record an increase in assets or expenses.

- tax deduction : an expense or allowance that reduces taxable income and, consequently, the amount of taxes owed.

- interpreting : financial data are analyzed, and is a crucial tool for

- accrual : income should be recognized at the time it is earned.

- gross profit : the profit a company makes after deducting the cost of goods sold from its revenue.

- assets : resources or items of value owned by a business such as accounts receivable.

- matching : the principle is the basis of the accrual principle.